A Peak behind the scenes of the wholesale market

and the Fancy Color Diamond investment platforms

The COVID-19 pandemic brought with it unprecedented chaos. Angry mobs looting Fifth Avenue stores and a complete lack of clear governmental policy has left many high-net-worth individuals with a feeling of uncertainty, tempting investors to seek out portable forms of wealth. During this period of upheaval, and in light of the attention the Fancy Color Diamond Index received from the international financial community, we were asked to paint a general background on this asset class and answer members’ many questions about the investment perspective of these rare gems.

“What are the benefits of investing in Fancy Color Diamonds in comparison to other luxurious collectibles?” Which platform enables short-term trading for these natural diamonds? “How does this alternative investment category behave in times of crisis?” “What are the pros and cons compared to other investments?” and “What would be the right investment approach without overpromising results?”

During this past year we have compiled our answers and up-to-date market analysis into this readily available report for the benefit of our members from the financial sector.

——————————————————————————————————-

The combination of the words “Fancy Color Diamonds” and “investment” is quite common outside the wholesale market, with many referring to Fancy Color Diamonds as “an alternative investment vehicle.” Because there is no clear investment practice for Fancy Color Diamonds and no transparency regarding margins or inventory time cycles, sprouting “investment agents” in this category tend to introduce many investment terms that are sometimes confusing, inaccurate and unrealistic.

An important but incorrect belief that needs to be refuted is the premise that Fancy Color auction results can be used as a reference for a generic pricing database. In most cases, Fancy Color Diamonds offered for sale at auctions are stones that were rejected by professional dealers due to typical quality flaws that make these diamonds “a hard sell.” Diamonds at auction represent a very small and inconsistent sample of the diamonds in the market. In fact, the vast majority of Fancy Color Diamonds outside the auction are of much higher quality and are mostly sold by retailers for higher prices. Following the COVID-19 events and the renewed need by various investment agents to explore investing in Fancy Color Diamonds, we decided to review a few industry fundamentals with the hope that we can crystallize the differences among the various investment options and calibrate investor expectations accordingly.

Background

During the 1960s and 1970s, people who owned a large jewelry collection but were still on the lookout for unattainable gems, gravitated towards Fancy Color Diamonds, without thinking of them as investments. During those years, Color Diamonds simply became a symbol of exotic yet refined taste. Today’s collectors wear multimillion-dollar Fancy Color jewelry as a way of saying who they are without having to speak.

Generally speaking, investing in Fancy Color Diamonds can be profitable, yet doing so is not a trivial task. Hence, investors need to calibrate their expectations regarding the maturity timeline of this investment, expected margins, and the platform through which they will later liquidate these diamonds — if needed.

The notion that Fancy Color Diamonds could be a personal investment emerged in the 1990s, right after buyers noted sharp price increases in the Fancy Color market. Two decades later, after the world had recovered from the subprime meltdown and Fancy Color prices had shown that they could outperform alternative asset classes, the investment community started showing interest in these gems and some local investment initiatives began to take shape.

In the last few decades, the category of rare Fancy Color Diamonds has constantly increased in price. The Natural Colored Diamond segment is considered to be the least volatile among traditional and alternative asset classes. For example, Blue Fancy Color Diamonds have appreciated by 241% since 2005, while Pink Fancy Color Diamonds have increased by 366%. Incidentally, both categories experienced no significant decreases throughout that period.

Unlike traditional investments that yield income but may fluctuate in value, Fancy Color Diamonds are primarily objects of beauty and passion; they became desirable collectibles among those who realized that Fancy Color Diamonds are a limited resource. As supply is constantly diminishing, new collectors continue to join the club, which enables this exclusive niche to remain stable over the years. A Gerhard Richter painting, a 1963 GTO Ferrari, and a 3-carat Fancy Vivid Pink will not produce an IRR when owned privately; they will nevertheless gradually increase in value or maintain their price. Of all alternative investments, a Fancy Color Diamond has unique benefits that address a long-term, intimate family need, a point we will touch on later.

Behind the Scenes of the Wholesale Ecosystem

The diamond business culture evolved around the notion that a diamond has a unique size-to-value ratio. Therefore, it seemed unnecessary to develop a documented business protocol for an object you can literally pass from hand-to-hand. As diamond trading turned into an industry, today’s markets maintained their “family business” culture and created a closed, legitimate “ecosystem,” based on high morality, absolute trust, and minimal bureaucracy. The fact that governments today allow stones to be delivered to diamond centers door-to-door, with minimal import tax and little bureaucracy, is a sign of confidence. To the surprise of many outsiders, transactions that are of equal value to a residential building are still sealed by saying one Hebrew word — “Mazal” — that simply means “luck.” The business categories included in the first tier are mining companies, diamond manufacturers, wholesale traders, and retailers. Once you become part of this system, you can enjoy the relatively fast movement of goods and generate the moderate profits it allows.

Industry Selling Cycles

To place things in perspective and to coordinate expectations with the various investment approaches, we need to get acquainted with the Fancy Color industry’s sales cycles (especially as most investment platforms claim to have the skills of an experienced industry trader). After conducting a survey among the leading Fancy Color Diamond dealers, we were able to identify various inventory cycles. Their numbers shed light on some investment factors we need to consider.

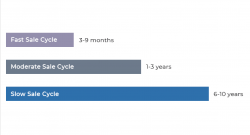

In the wholesale market, we found three different time cycles for Fancy Color Diamond sales: Fast, Moderate, and Slow.

- Fast-moving — Fancy Color Diamonds will be sold at wholesale within three to nine months from the moment a gemological report is issued for the stone.

- A Moderate sales cycle will take one to three years.

Slow-moving items will be sold between six to10 years.

What Turns the Wheels?

WHOLESALER TO WHOLESALER – We found that the main factors affecting the turnaround period in one’s inventory is merely the relationship between the diamond’s price, its beauty, and its rarity. As dealers are mainly driven by business opportunities, discounting a price-per-carat, or re-polishing the stone to improve its overall esthetics could shorten a stone’s stay in one’s inventory.

DEALER TO RETAILER – When we examined transactions between diamond dealers and retailers, we identified yet another set of factors and considerations. Retailers feel more comfortable visualizing a Fancy Color Diamond in the context of a jewel and apply a more holistic approach. As jewelers assign greater importance to the piece of jewelry in which the stone will be mounted, they give greater weight to the buyer’s overall budget and aesthetic rather than a particular discount on the price-per-carat.

RETAILER TO END CLIENT – When it comes to the transaction cycle between retailers and end consumers, the time that a natural colored diamond remains in an inventory is affected by three main variables: the jewel’s overall beauty, a skilled sales team that knows a substantial number of talking points to convey the story of the jewel, and –as strange as it may sound — timing; having the right stone at the right time. Interestingly, we found that retailers owning a larger Fancy Color Diamond inventory reported better control on the quality and owning them at a lower cost per carat. As a result, those retailers were more motivated to train and excite their sales teams, thereby obtaining better margins and achieving a faster turnaround in comparison to the stones they had on consignment. From the point of view of financial leverage, the excess profits retailers made on the goods they owned were greater than the cost of the money saved on similar goods taken on consignment.

The Second Tier – Investment Platforms

The second tier, a category in itself, addresses a relatively new trend in the Fancy Color Diamond landscape. This category, which lies outside of the traditional Fancy Color trade, includes business platforms that own an inventory on behalf of private investors in order to trade and produce short-term profits. An efficient and transparent structure is hard to find on this tier because its managers need a plethora of unique qualities. They need to combine the DNA of an experienced diamond wholesaler with the business conduct of a Wall Street fund manager. Furthermore, Fancy Color investment platforms need professional diamond buyers who have access to first-hand sources and savvy collectors who can buy these goods. Such a combination is very hard to find in one entity that is external to the trade.

Of the many challenges a trading platform faces, the most prominent is the inventory time cycle. Entities dealing with alternative asset classes are expected to generate double-digit returns on a yearly basis (at least 18%-28% annually). They also need to be within a predetermined investment period, i.e., three to five years, in order to be competitive. In reality, a diamond fund’s value proposition is not always consistent with the Fancy Color inventory market cycle described above. It so happens that slow-moving items exist in every diamond inventory, and their inherent life cycle is usually longer than the investment proposition offered by alternative platforms. As such, their time cycle will disrupt the yield forecast given to investors, reached when liquidation is required at the end of the fund’s lifetime. However, if an investment platform has an efficient exit strategy, it will potentially be able to keep up with the time frame promised and still yield a conservative IRR.

The second tier also includes investment companies that promote Fancy Color Diamonds as short-term investments. These companies usually use an in-house call center with well-trained salespeople. These companies generally sell more-affordable Fancy Color Diamonds, usually stones that are below the one-carat size, such as the pink diamonds originating in Australia’s Argyle mine, to adventurous collectors. Platforms in this tier that sell Fancy Color Diamonds at modest margins, can still live up to the profit expectations they promise.

Privately Owned Diamonds

Fancy Color Diamond jewelry, owned by an individual, will most likely mature as an investment following a long period. However, during this time, owners can enjoy a different set of advantages in case the need for a ‘cash-out’ arises. A Fancy Color Diamond mounted in jewelry can be sold globally and privately, much more readily than a colorless diamond can, and without being subjected to any price list or sharp price drops.

When it comes to the stone’s physical aspects, we recognize a few benefits for the diamond category as a whole. The first is a unique value-to-size ratio when compared with other alternative asset classes such as gold, art, vintage cars, or wine. The second, the fact that a multimillion-dollar diamond is an eminently wearable object, gives its owner a strong sense of freedom and independence, two advantages that should not be underestimated in times of crisis.

The latter is tied to regulation and inheritance tax: Because diamonds are personal, wearable objects (similar to collectible watches), they are among the few multi-million dollar assets that, in most countries, can be physically handed over to loved ones without being subjected to any legal proceedings.

The issue of fixed cost in alternative investments such as vintage cars, thoroughbred horses, collectible wine, and, in some cases, even commercial real estate, can be crucial as well. This is especially the case when we need to include maintenance or storage in the equation. The substantial amount generated by fixed costs may easily become burdensome in periods of financial distress. A diamond portfolio or a jewelry collection, regardless of its value, requires no maintenance, nor does it take up any space when stored in a home safe.

From interviews conducted with leading jewelry brands, we found that IRR expectations appear low on the list of the end-client’s priorities. The main motivation driving private collectors to acquire Fancy Color Diamonds appears to be the pleasure of exhibiting their refined taste and celebrating their personal success. Most collectors are aware of the fact that a Fancy Color Diamond can mature as an investment after a long period of time, and, if necessary, may be sold to another collector. An individually-owned gem can be sold through different on-line or off-line consignment platforms, such as auction houses or on-line companies specializing in second-hand luxury goods. Other collectors feel that such a diamond is an ideal and timeless commodity, one that can be passed on continuously within the family as “the guardian angel of portable wealth.” The fact that the vast majority of mines will stop unearthing rough in about 60 years reinforces this notion exponentially.