FCDI Q4 2022

FCRF: Fancy Diamonds Outperform Main Markets in 2022

New York, January 31st, 2023: The Fancy Color Research Foundation (FCRF) today announced the results of the Q4 and full year 2022 Fancy Color Diamond Index (FCDI).

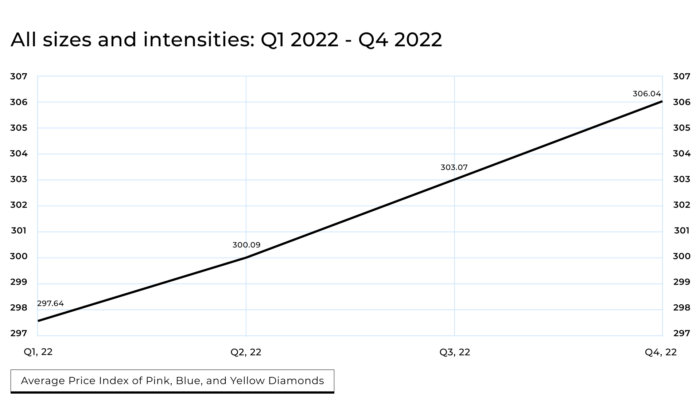

The average price of all colors and sizes of fancy color diamonds climbed by 3.9% in 2022, led by a 4.6% increase in all Yellows and followed by a 3.9% rise in Pinks and 1.8% in Blues. This climb was in contrast to the annual decline in white diamonds and other major financial markets.

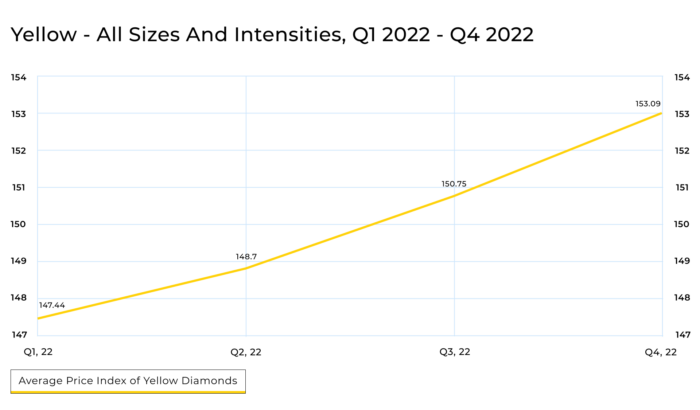

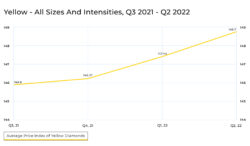

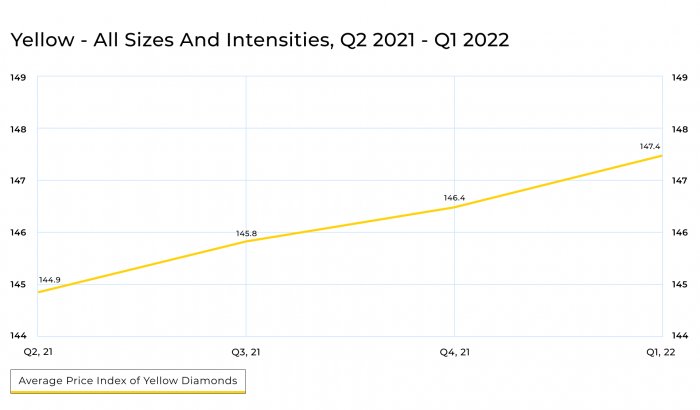

Yellow

The annual increment of the Yellow category was led by an increase of 5.6% in the Intense grade across all sizes, 5.5% rise in the Fancy grade and 3.7% in the Vivid grade. The sharpest increase of 9% in the past year was seen in the Fancy 8 carat grade, and Fancy Vivid 5 carat increasing by 6.6%. In Q4 2022, all Yellows rose by 1.5% with no decrease seen in any segment.

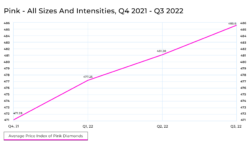

Pink

In Q4 2022, Pinks of all sizes appreciated by 0.8%. 1.5 carat Pinks in the Vivid grade increased by 4.6% and were the main contributor to the overall increase. During 2022, weight categories below 8 carats presented significantly better results (with an average climb of 5.5%) than higher weight categories. The Vivid 1.5 carat grade was the highest climber among all fancy diamonds in 2022, with an increase of 9.3%.

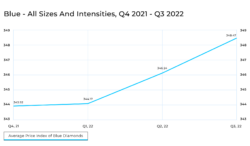

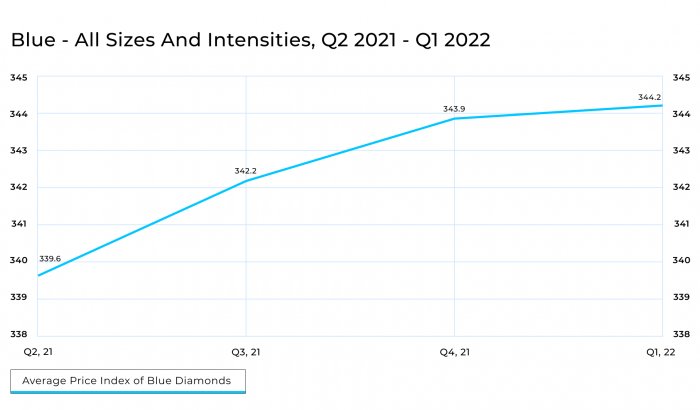

Blue

Blue diamonds showed a moderate increase of 0.4% in the last quarter, and completed a 1.8% appreciation for the whole year. In 2022, the Fancy Vivid category rose by 2.7%, outperforming the Fancy grade that increased by 1.5% and the Fancy Intense that decreased 0.3%. The highest increase of 6.4% in the Blue segment was in the 2 carat category.

For a complete data analysis, please visit www.fcresearch.org

FCRF Data Supplier Israel Papushado:

“2022 was a very good year for Yellow fancy color diamonds in all sizes and saturations. It seems like Yellow diamonds with high visual grades and in certain shapes increased by more than what is reflected in the Index. Pink fancy color diamonds performed with no significant change in comparison to previous years , however, Blue diamonds did not perform as expected, probably due to limitations in the Chinese market which seems to change very soon.”

| Category | Q4/22 vs. Q3/22

T3 |

Q4/22 vs. Q4/21

TTM |

| All Fancy Color Diamonds | 1.0% | 3.9% |

| All Yellow Fancy Color Diamonds | 1.5% | 4.6% |

| All Pink Fancy Color Diamonds | 0.8% | 3.9% |

| All Blue Fancy Color Diamonds | 0.4% | 1.8% |

The Fancy Color Diamond Index is published by the non-profit Fancy Color Research Foundation (FCRF), tracking pricing data for Yellow, Pink, and Blue Fancy Color Diamonds in the major global trading centers – Hong Kong, New York, Geneva, and Tel Aviv.

About the FCRF

The Fancy Color Research Foundation (FCRF) provides fact-based support for Fancy Color Diamonds as an asset class and empowers sellers with the unparalleled proficiency that the field demands. A non-trading organization, the FCRF promotes transparency and fair trade through the Fancy Color Diamond Price Index, rarity data, auction analyses, commercial research, and objective valuations. To learn more, go to https://www.fcresearch.org/

FCDI Q3 2022

Q3: Price of Fancy Color Diamonds Rose 1.0% in Q3 2022

Yellow fancy color prices showed the highest increase

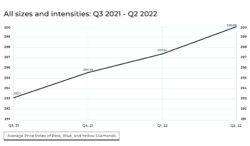

New York, November 15, 2022: The Fancy Color Research Foundation (FCRF) announced the results of the Fancy Color Diamond Index (FCDI) for the third quarter of 2022. After an increase of 0.8% in Q2 2022, the average price of all colors and sizes of fancy color diamonds climbed by 1.0% in Q3 2022. This climb was in contrast to the trend in white diamonds, which declined by 6.7%. Fancy Vivids across all color categories presented the highest increase (1.8%), with Fancy Vivid 8 carats demonstrating a rise of 3.6%, led by Fancy Vivid Pink 8 carats (5.5%). Overall, in the last 12 months, the Yellow segment in all sizes and saturations rose by 3.4% on average, Blues rose by 1.8%, and Pinks by 3.7%.

Yellow

The Yellow segment rose overall by 1.4% in Q3 2022, led by an increase of 1.7% in the Fancy Intense category, and 1.6% in the Fancy category. The highest increase was evident in the Fancy Vivid 8 ct category (4.0%), with Fancy Intense 3 ct (3.3%) being the runner-up. In Q3 2022 all Yellow diamonds climbed except Fancy Intense 8 ct (-0.7%).

Pink

Pink diamonds rose overall by 0.9%, driven mainly by the Fancy Vivid category that increased by 2.7%. The Fancy and Fancy Intense grades climbed by 0.5% and 0.4%, respectively. Interestingly, Fancy Vivid 8 ct was the highest climber (5.5%) while Fancy Intense 8 ct was the highest slider (-2.2%).

Blue

Blue diamonds increased by 0.6% in Q3 2022 with Fancy Vivid 2 ct and 1.5 ct presenting the highest climb, 2.6% and 1.8%, respectively. The Fancy Vivid category (1.0%) outperformed the Fancy and Fancy Intense categories (0.2% and 0.4%). The weakest result was evident in Fancy Intense 10 ct (-1.1%).

For a complete data analysis, please visit www.fcresearch.org

FCRF Board member Eden Rachminov said: “The index results reflect price changes in cushion-shaped diamonds with average visual characteristics. From what I have seen, the price of stones with high-quality visual properties and shapes that are in high demand has increased even higher than what is reflected in the graphs“.

| Category | Q2/22 vs. Q1/22

T3 |

Q2/22 vs. Q2/21

TTM |

| All Fancy Color Diamonds | 1.0% | 3.4% |

| All Yellow Fancy Color Diamonds | 1.4% | 3.4% |

| All Pink Fancy Color Diamonds | 0.9% | 3.7% |

| All Blue Fancy Color Diamonds | 0.6% | 1.8% |

The Fancy Color Diamond Index is published by the non-profit Fancy Color Research Foundation (FCRF), tracking pricing data for Yellow, Pink, and Blue Fancy Color Diamonds in the major global trading centers – Hong Kong, New York, Geneva, and Tel Aviv.

About the FCRF

The Fancy Color Research Foundation (FCRF) provides fact-based support for Fancy Color Diamonds as an asset class and empowers sellers with the unparalleled proficiency that the field demands. A non-trading organization, the FCRF promotes transparency and fair trade through the Fancy Color Diamond Price Index, rarity data, auction analyses, commercial research, and objective valuations. To learn more, visit https://www.fcresearch.org/

FCDI Q2 2022

Q1 2022: Fancy Color Diamond Index shows overall rise, leads most global indices in Q2 2022

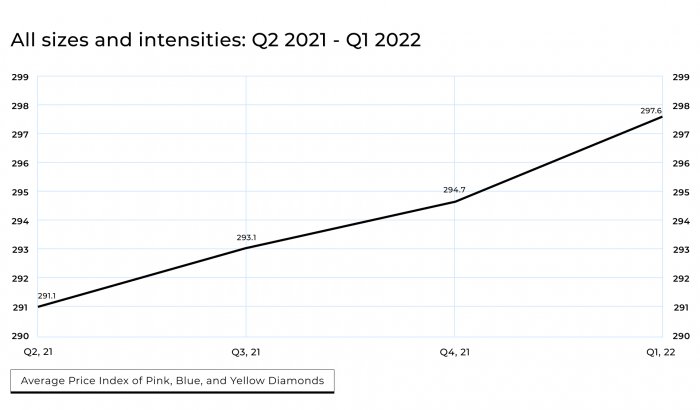

New York, August 1st, 2022: The Fancy Color Research Foundation (FCRF) announced the results of the Q2 2022 Fancy Color Diamond Index (FCDI). The price rise in all colors and sizes of fancy color diamonds continued this quarter, with an average increase of 0.8%. This upward trend is apparent compared to other global indices, such as the Dow Jones -11.3%, the S&P -16.4%, gold -6.7%, and white diamonds -4.0%.

Fancy Vivids across all color categories showed an increase of 1%, with a rise of 2.6% over the past 12 months. The Fancy and Fancy Intense categories showed an increase of 0.7% and 0.8% respectively, with a 3.5% and 3.2% rise over the past 12 months.

Yellow

The Yellow segment rose overall by 0.9% in Q2, led by an increase of 1.5% in the Fancy category, and 1.2% in the Fancy Intense category. The most noticeable increase is in the Fancy 8 ct category (4.9%), while the 5 ct and 8 ct in all intensities rose by 2.1% and 1.6%, respectively. This quarter, the weakest performance was in Fancy Intense 1.5 carat (-0.8%).

Pink

Pink diamonds rose overall by 0.8%, driven mainly by the Fancy Vivid category that increased by 1.5%, and the Fancy Vivid 10 ct and Fancy 2 ct categories, both of which rose by 0.9%. The biggest increase over the past 12 months was seen in the Fancy 5 ct category (6.3%). The only significant decrease this quarter was in the Fancy 8 ct with a -1.3% decrease.

Blue

10 ct Blues of all intensities showed the highest rise (2.1%), with the Fancy 10 ct category rising by 2.2% this quarter and the Fancy Vivid 10 ct category a close second (2.1%). The Fancy Intense 1 ct category rose most during the past year (5.2%), outperforming Fancy 1 ct and Fancy Vivid 1 ct, which rose by 1.1% and 1.6% over the past 12 months, respectively. No categories decreased by over one percent this quarter, with the closest being a -0.8% drop in the Fancy 3 ct category

FCRF Board member Ishaia Gol explained:

“It is evident that the increase in prices is driven by two market forces that haven’t occurred simultaneously in quite some time: That is, high demand for fancy color diamonds on the retail side, and fierce competition on rough in tenders.”

| Category | Q2/22 vs. Q1/22

T3 |

Q2/22 vs. Q2/21

TTM |

| All Fancy Color Diamonds | 0.8% | 3.1% |

| All Yellow Fancy Color Diamonds | 0.9% | 2.6% |

| All Pink Fancy Color Diamonds | 0.8% | 3.4% |

| All Blue Fancy Color Diamonds | 0.6% | 2.0% |

The Fancy Color Diamond Index is published by the non-profit Fancy Color Research Foundation (FCRF), tracking pricing data for Yellow, Pink, and Blue Fancy Color Diamonds in the major global trading centers – Hong Kong, New York, Geneva, and Tel Aviv.

About the FCRF

The Fancy Color Research Foundation (FCRF) provides fact-based support for Fancy Color Diamonds as an asset class and empowers sellers with the unparalleled proficiency that the field demands. A non-trading organization, the FCRF promotes transparency and fair trade through the Fancy Color Diamond Price Index, rarity data, auction analyses, commercial research, and objective valuations. To learn more, go to https://www.fcresearch.org/

FCDI Q1 2022

Q1 2022: Pinks rise 1.3% to lead fancy color diamond price gains in Q1 2022

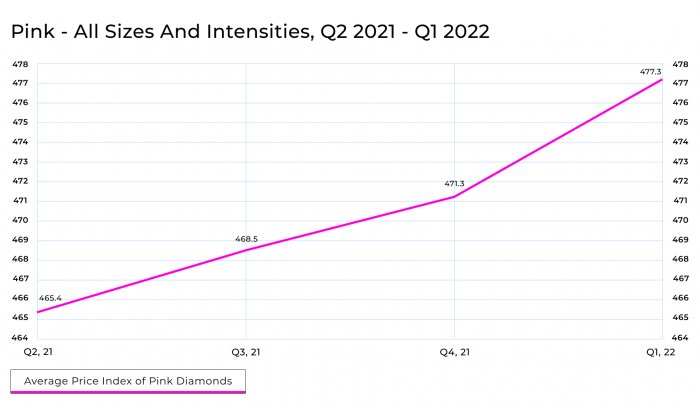

New York, May 4, 2022: The Fancy Color Research Foundation (FCRF) today announced the results of the Q1 2022 Fancy Color Diamond Index (FCDI). Prices of Fancy Color Diamonds continued 2021’s positive trend and rose by 1.0% across the board. The general increase was led by Pinks at 1.3%, with Yellows following at 0.7% and Blues showing nearly no change.

The Fancy category and Fancy Intense in all colors, showed an increase of 1.3% and 1.2% respectively, outperforming the Fancy Vivid segment at 0.6%.

Pink

Pink diamonds’ general price increase of 1.3% was mainly driven by the Fancy category (1.7%) in the 1 and 2 ct weight categories: 2 ct in Fancy Intense (3.5%), 2 ct in Fancy Vivid (3.2%), and 1 ct Fancy Intense (2.9%). Larger weight categories also exhibited significant price increases, with Fancy Vivid 10 carat and Fancy Intense 3 carat leading this color category, both rising 2.2%.

The only two pink categories whose prices decreased this quarter were the Fancy Vivid 3 carat and the Fancy 8 carat, both with a 0.3% decrease.

Blue

Fancy Blues showed overall stability in Q1 (0.1%) in all weight categories (0.0%-0.6% change). Fancy Intense grade (0.5%) outperformed Fancy Vivid (0.0%) and Fancy (-0.5%) grade saturations. The only two categories that fluctuated more than one percent were: Fancy Intense 2 carat, which climbed by 1.3%, and Fancy 3 carat, which fell 1.3%.

Yellow

The Yellow category rose by 0.7% in Q1, mostly due to appreciation in the Fancy Intense grade (1.1%). Across the board, diamonds above 5 carats rose more than diamonds below this weight (1%+ vs. <1%, respectively). Fancy Intense 8 carat stood out with an increase of 2.5%. The weakest performance in Q1 was noted in Fancy Vivid 1.5 carat (-0.5%).

For a complete data analysis, please visit www.fcresearch.org

| Category | Q1/22 vs. Q4/21

3M |

Q1/22 vs. Q1/21

12M |

| All Fancy Color Diamonds | 1.0% | 2.5% |

| All Yellow Fancy Color Diamonds | 0.7% | 1.9% |

| All Pink Fancy Color Diamonds | 1.3% | 2.8% |

| All Blue Fancy Color Diamonds | 0.1% | 1.7% |

FCRF Advisory Board member Eden Rachminov explained:

“The results of the index reflect pre-boycott prices on Russian diamonds. Since this boycott, the supply of yellow diamonds has dropped dramatically. The price increases also take place while China is under a harsh lockdown. Once their Covid policy will dissolve and Chinese diamond lovers will return to the market, we will witness a burst in demand for luxury goods and fancy color diamonds in particular, followed by an additional significant price increase.“