FCDI Q4 2023

FCRF: 2023 Showcases Impressive Growth in Fancy Color Diamonds,

Led by a 4% Increase in Yellow Diamonds

New York, February 5th, 2024: The Fancy Color Research Foundation (FCRF) today announced the results of the Q4 2023 Fancy Color Diamond Index (FCDI).

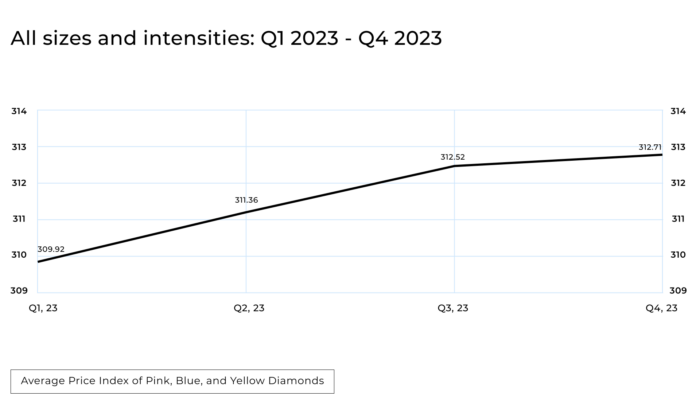

In 2023, the market for fancy color diamonds (FCD) demonstrated steady growth, with the average price increasing by 2.2%. Leading this growth were Fancy Yellow diamonds, which experienced the most significant annual rise. Vivid Yellow diamonds also had a notable increase, with their value rising by 4.3% over the year. Notably, Fancy Vivid Pink 1-carat diamonds underwent a remarkable surge in value, with a substantial increase of 12.0%.

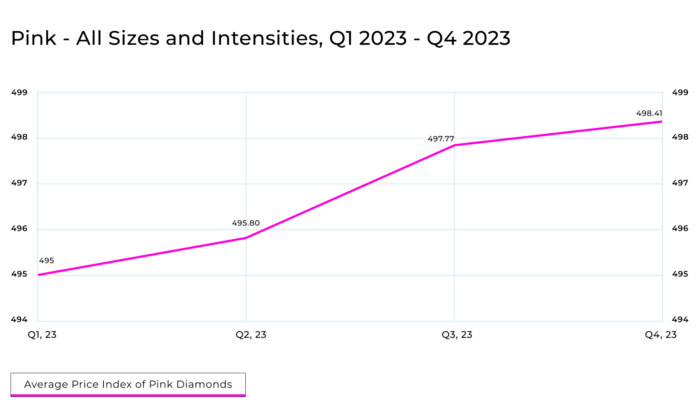

Additionally, Fancy Intense Pink 1-carat experienced a substantial rise of 10.8%. Pink and Blue diamonds exhibited modest fluctuations while retaining their value. Despite some fluctuations, the Fancy and Intense grades contributed positively to the year’s overall growth. However, colorless diamonds, on average, depreciated this year by 16.5%.

Q4 2023

The fourth quarter of 2023 saw the continuation of this positive trend in the FCD market, with a slight increase of 0.1% in average prices. This increase, though modest, reflects the growing interest in fancy-color diamonds.

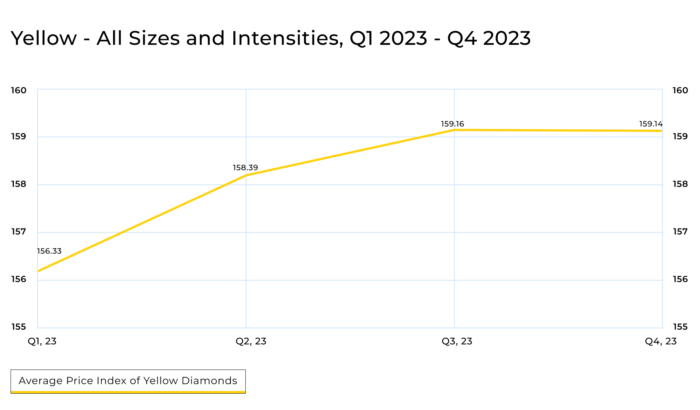

Over the last year, the Yellow category has shown significant growth, with an annual increase of 4.0%, mainly in the first three quarters. The Vivid category led the annual growth with a 5.3% rise, underscoring its strong market performance throughout the year. The Yellow diamond segment saw varied performance across different sizes. The 8-carat Fancy Vivid Yellow category led the annual growth with an impressive 10.1% rise (0.7% in Q4), marking the highest increase within the Yellow category. The 1.5-carat Fancy Yellow decreased by 0.5% annually, as well as the Fancy Intense Yellow 8-carat category.

Over the past year, Pink Diamonds have demonstrated consistent growth in the market. This category achieved an overall annual increase of 1.8%, (0.1% in the Q4)

The Vivid category marked the most significant growth in pinks, both quarterly and annually, experiencing a substantial increase of 1.0% in the fourth quarter and an annual growth of 4.4%, leading the gains in this segment. Among specific sizes, the 1-carat Pink diamonds recorded the largest growth, with a 2.0% increase this quarter and an impressive 8.3% rise over the year. Conversely, the 5-carat Pink diamonds experienced the largest quarterly decrease of 0.5%, though they still achieved an overall annual increase of 1.7%, showcasing their enduring market strength.

Notably, three of the top annual climbers in the Pink diamond category were Fancy Vivid Pink 1-carat, with a remarkable 12.0% increase, Fancy Intense Pink 1-carat, with a 10.80% rise, and Fancy Vivid Pink in 1.5-carat, with a significant increase of 9.40%.

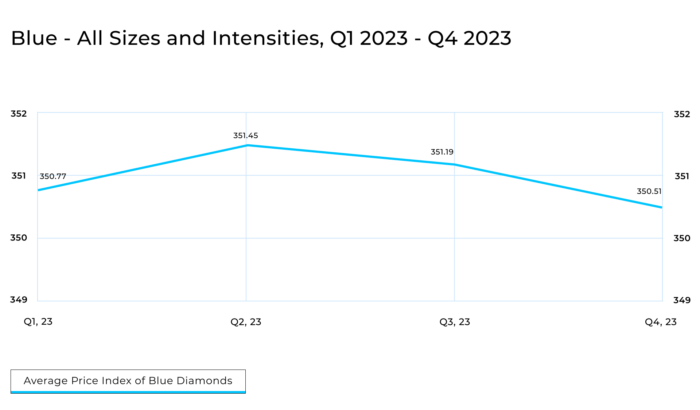

Over the last 12 months, the Blue Diamond category has managed to maintain a marginal growth of 0.1%, despite experiencing a slight decline in the fourth quarter of 2023 with a 0.2% decrease in average price. Within this category, the Vivid Blue segment showed a notable annual increase of 1.2%.

The standout performer in the Blue diamond category for the year was the Fancy Vivid Blue in the three-carat segment, which demonstrated an impressive annual growth of 3.5% and a quarterly increase of 0.4%. This strong performance highlights its significant demand and market strength. In contrast, the most significant decrease during the quarter was observed in the 1-carat Blue diamonds, while 3-carat Blue diamonds across all intensities showed no change in price, maintaining stability in the market.

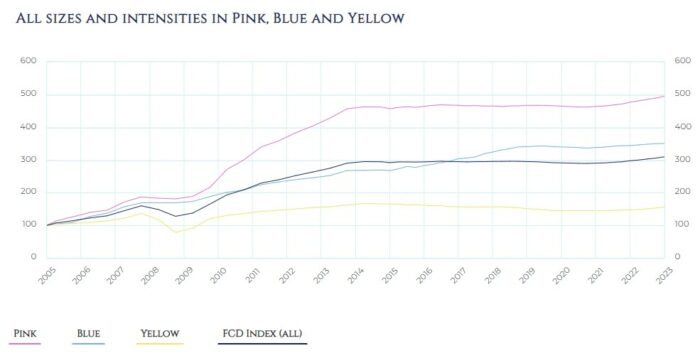

Since the establishment of the Fancy Color Research Foundation, there has been a significant uptrend in all Fancy Color Diamonds, marking an impressive surge of 212.7%. Yellow diamonds experienced a notable increase of 59.1%, Pink diamonds exhibited a surge of 398.4% and Blue diamonds showed a substantial increase of 250%.

For complete data analysis, please visit www.fcresearch.org

FCRF Data Supplier Ephraim Zion said:

“The fancy color diamond index mirrors shifts in the global economy intriguingly. Despite sustained interest in these rare gems, there’s a noticeable shift to smaller carat weights, attracting lower total investments. This trend has notably compensated with a stronger demand for diamonds with higher saturation such as Intense and Vivid. As the global economic climate recovers, it’s anticipated that demand for larger carat weights will resurge”

| Category | Q4/23 vs. Q3/23

T3 |

Q4/23 vs. Q4/22

TTM |

| All Fancy Color Diamonds | 0.1% | 2.2% |

| All Yellow Fancy Color Diamonds | 0.0% | 4.0% |

| All Pink Fancy Color Diamonds | 0.1% | 1.8% |

| All Blue Fancy Color Diamonds | -0.2% | 0.1% |

The Fancy Color Diamond Index is published by the non-profit Fancy Color Research Foundation (FCRF), tracking pricing data for Yellow, Pink, and Blue Fancy Color Diamonds in the major global trading centers – Hong Kong, New York, Geneva, and Tel Aviv.

About the FCRF

The Fancy Color Research Foundation (FCRF) provides fact-based support for Fancy Color Diamonds as an asset class and empowers sellers with the unparalleled proficiency that the field demands. A non-trading organization, the FCRF promotes transparency and fair trade through the Fancy Color Diamond Price Index, rarity data, auction analyses, commercial research, and objective evaluations. To learn more, go to https://www.fcresearch.org.

FCDI Q3 2023

FCRF: Fancy Color Prices Show Resilience While White Diamond Decrease

New York, October 23rd, 2023: The Fancy Color Research Foundation (FCRF) today announced the results of the Q3 2023 Fancy Color Diamond Index (FCDI).

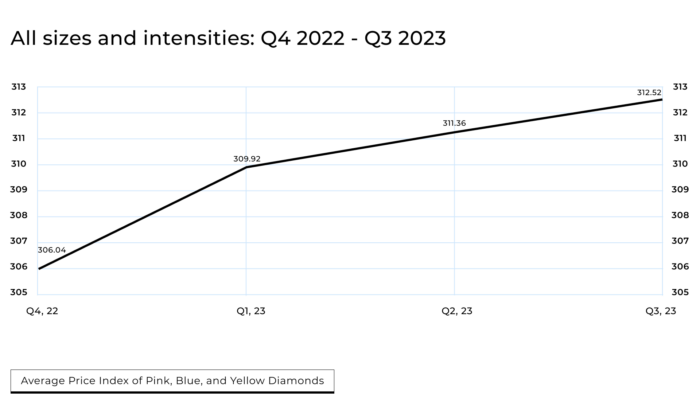

During the third quarter of 2023, the average price of fancy color diamonds continued to rise by 0.4%, achieving a 3.1% increase in the last 12 months. Contrary to, colorless diamonds which decreased dramatically.

Across all color categories, the Vivid grade exhibited the highest increase of 1% overall. Subsequently, both Fancy and the Intense grade exhibited marginal growth, contributing to an overall increase of 0.2%. Notably, in the third quarter of 2023, the Yellow category demonstrated an appreciation of 0.5%, closely trailed by Pinks at 0.4%, Blues exhibited a 0.1% decrease

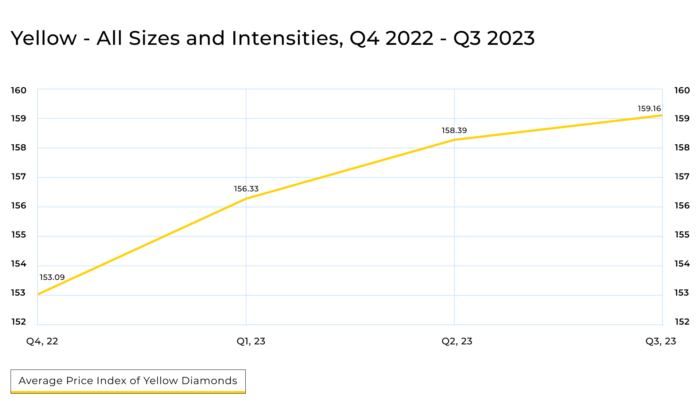

The annual increment in the Yellow category was primarily driven by a 0.5% increase. The Vivid grade experienced a 1.4% increase across all sizes, while the Fancy and Intense grades displayed an average decrease of 0.55%. The most substantial surge was observed in the Vivid 3-carat category, rising by an impressive 4.2%. The 5 carat fancy grade followed with an increase of 1.1%. Additionally, the Intense grade demonstrated a slight uptick in the 1-carat segment, with a 0.3% increase.

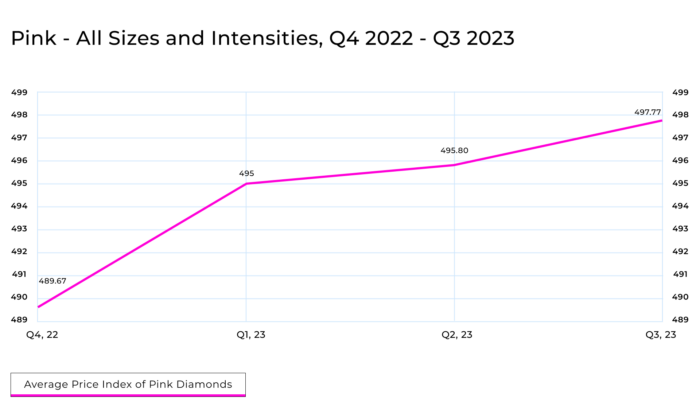

Pink diamonds demonstrated an overall growth of 0.4%, led by the Vivid category, showing an increase of 1%. The Fancy grade contributed to this increase with a 0.6% rise, while the intense category remained stable, with soft results in the larger weights. The highest increase of 4.4% was in the 1ct Intense pink and a 1.4% decrease in the 10ct Intense pink.

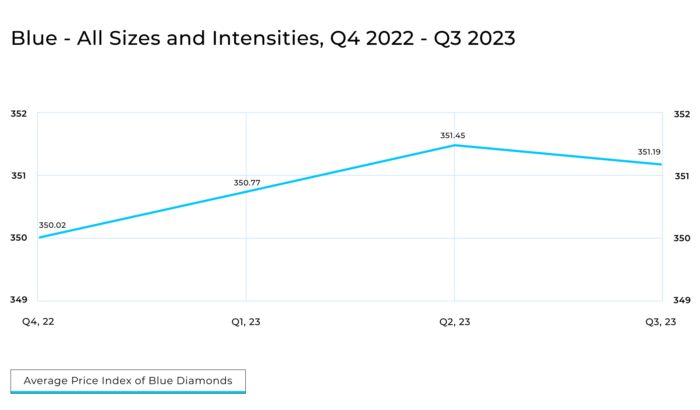

In Q3 2023, blue diamond prices showed a minor decline, mainly in the Fancy grade category decreasing by 0.5%, the Vivid and Intense grades remained unchanged. The 10-carat intense blue segment demonstrated a 1.1% increase, while the Fancy 3-carat category showed a decrease of -1.1%.

Since the establishment of the Fancy Color Research Foundation, there has been a significant uptrend in all Fancy Color Diamonds, marking an impressive surge of 212.5%. Yellow diamonds experienced a notable increase of 59%, Pink diamonds exhibited a surge of 398% and Blue diamonds showed a substantial increase of 251%.

For a complete data analysis, please visit www.fcresearch.org

FCRF Data Supplier Matthew Aldridge said:

“In times when interest rates rise and white diamond prices decrease, it’s intriguing to observe the price resilience of fancy color diamonds. Their stability instills confidence in retailers who hold substantial inventory.”

| Category | Q3/23 vs. Q2/23

T3 |

Q3/23 vs. Q3/22

TTM |

| All Fancy Color Diamonds | 0.4% | 3.1% |

| All Yellow Fancy Color Diamonds | 0.5% | 5.6% |

| All Pink Fancy Color Diamonds | 0.4% | 2.5% |

| All Blue Fancy Color Diamonds | -0.1% | 0.8% |

The Fancy Color Diamond Index is published by the non-profit Fancy Color Research Foundation (FCRF), tracking pricing data for Yellow, Pink, and Blue Fancy Color Diamonds in the major global trading centers – Hong Kong, New York, Geneva, and Tel Aviv.

About the FCRF

The Fancy Color Research Foundation (FCRF) provides fact-based support for Fancy Color Diamonds as an asset class and empowers sellers with the unparalleled proficiency that the field demands. A non-trading organization, the FCRF promotes transparency and fair trade through the Fancy Color Diamond Price Index, rarity data, auction analyses, commercial research, and objective valuations. To learn more, go to https://www.fcresearch.org.

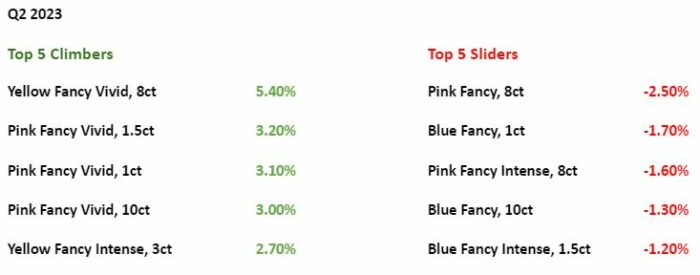

FCDI Q2 2023

FCRF: Fancy Color Diamonds Have Shown Consistent Upward Trend

New York, August 2nd, 2023: The Fancy Color Research Foundation (FCRF) today announced the results of the Q2 2023 Fancy Color Diamond Index (FCDI).

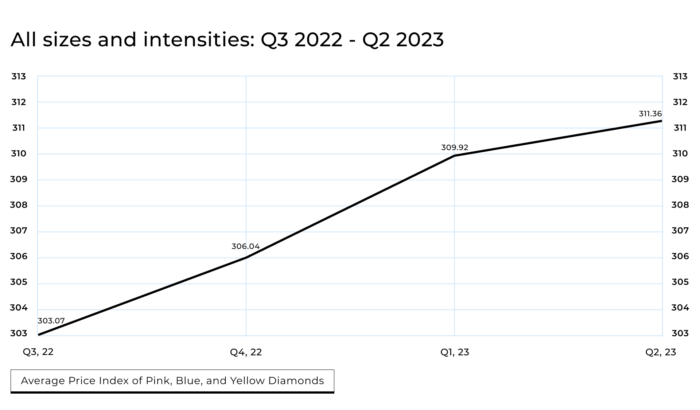

The average price of all colors and sizes of fancy color diamonds continued to climb in Q2 2023 by 0.5%. This climb was in contrast to the quarterly trend in white diamonds, which experienced decreases of -3.5% and -17.2% over the previous 12 months.

In all color categories, the Fancy Vivid grade had the highest increase of 1.2%. The other two saturation categories, Fancy and Fancy Intense, showed a combined rise below 0.3%. In Q2 2023, Yellows presented a more notable appreciation of 1.3%, while Pinks and Blues both showed an increase of 0.2%.

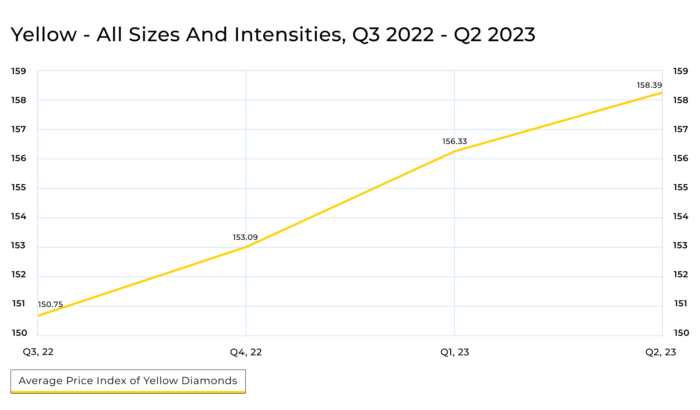

Yellow

The annual increment of the Yellow category was led by an increase of 6.5%. The Vivid grade increased by 1.5% across all sizes, followed by a 1.3% increase in the intense grade, and a 1.1% rise in the Fancy grade. The highest increase was evident in the Fancy Vivid 8ct category, which rose by 5.4%, In the Intense category, the 3ct increased by 2.7% being the runner-up. The three categories that slightly decreased (~0.5%) this quarter are Vivid grade 1.5ct, Intense grade 10ct and Intense grade 5ct.

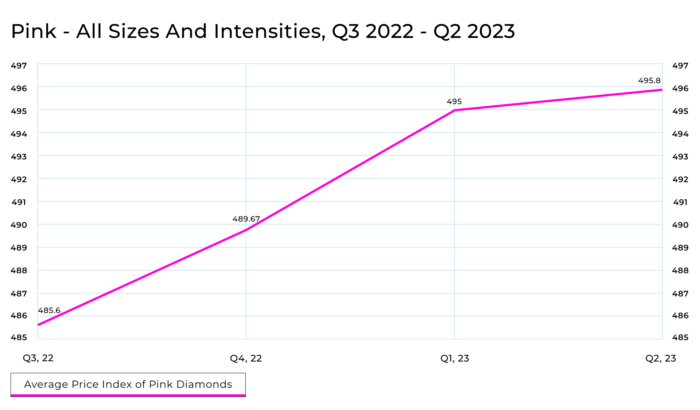

Pink

Pink diamonds rose overall by 0.2%, driven mainly by the Vivid category, which increased by 1.1%. The Fancy category was quite stable with no change, while the Fancy Intense Category decreased by -0.2%, driven by the larger carat sizes. The highest increase of 3.2% was in the 1.5ct Vivid grade, followed by an increase of 3.1% in the 1ct Vivid.

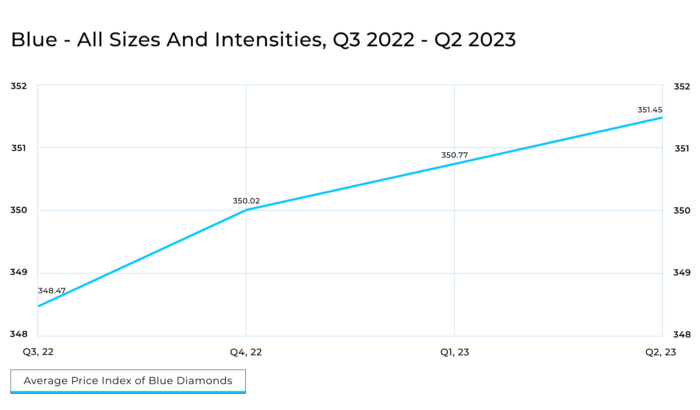

Blue

Blue diamond prices largely remained unchanged in Q2 2023, with the Vivid category increasing by 0.6%, outperforming the Fancy and Intense grades which remained unchanged. Among the Vivid grades, 5ct presented the highest climb, increasing by 1.6%. The weakest result was evident in Fancy 1ct which decreased by -1.7%.

Since the inception of the Fancy Color Research Foundation, All Fancy Color Diamonds have increased by 211%, Yellow diamonds have increased by 58%, Pink diamonds have had a remarkable 396% increase, and Blue diamonds have seen an increase of 251%.

For a complete data analysis, please visit www.fcresearch.org

FCRF Board Member Eden Rachminov said:

“The first six months of 2023 were intriguing. We experienced notable spikes in certain sub-categories within the yellow category, particularly in the intense and vivid grades with a high inner-grade. Meanwhile, the blue and pink categories remained stable. If the world economy continues to maintain its positive momentum, we can anticipate a robust price behavior after the summer.”

| Category | Q2/23 vs. Q1/23

T3 |

Q2/23 vs. Q2/22

TTM |

| All Fancy Color Diamonds | 0.5% | 3.8% |

| All Yellow Fancy Color Diamonds | 1.3% | 6.5% |

| All Pink Fancy Color Diamonds | 0.2% | 3.0% |

| All Blue Fancy Color Diamonds | 0.2% | 1.5% |

The Fancy Color Diamond Index is published by the non-profit Fancy Color Research Foundation (FCRF), tracking pricing data for Yellow, Pink, and Blue Fancy Color Diamonds in the major global trading centers – Hong Kong, New York, Geneva, and Tel Aviv.

About the FCRF

The Fancy Color Research Foundation (FCRF) provides fact-based support for Fancy Color Diamonds as an asset class and empowers sellers with the unparalleled proficiency that the field demands. A non-trading organization, the FCRF promotes transparency and fair trade through the Fancy Color Diamond Price Index, rarity data, auction analyses, commercial research, and objective valuations. To learn more, go to https://www.fcresearch.org/

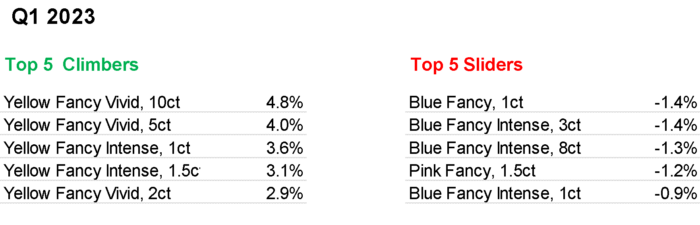

FCDI Q1 2023

FCRF: Fancy Diamonds Continue Solid Climb in Q1 2023

New York, May 4th, 2023: The Fancy Color Research Foundation (FCRF) announced the results of the Q1 2023 Fancy Color Diamond Index (FCDI). Following an increase of nearly 4% in 2022, the average price of all colors and sizes of fancy color diamonds continued to climb in Q1 2023 by 1.3%. This climb was in contrast to the quarterly trend in white diamonds of -2.8% and -17.6% over the previous 12 months.

Fancy Vivids across all color categories presented the highest increase (1.7%) in comparison to the Fancy Intense and Fancy categories which showed a moderate rise of 1.3% and 0.5% respectively. In Q1 2023, Yellows presented a more notable appreciation (2.1%) than Pinks (1.1%) and Blues (0.2%).

Yellow

The Yellow segment rose overall by 2.1% in Q1 (6% in TTM), led by an increase of 2.5% in the Fancy Vivid category, and 2.0% in the Fancy Intense category. The highest increase was evident in the Fancy Vivid 10 ct category (4.8%), with Fancy Vivid 5 ct (4.0%) being the runner-up. Fancy Vivid 3 ct (0.3%), Fancy 5 ct (0.3%) and Fancy 8 ct (0.2%) experienced the most modest gains for Yellows.

Pink

Pink diamonds rose overall by 1.1%, driven mainly by the Fancy Vivid and Fancy Intense categories, which both increased by 1.3%. The Fancy category was quite stable, climbing by only 0.3%. Interestingly, Fancy 1.5 ct was the only category which presented depreciation (-1.2%).

Blue

Blue diamond prices almost remained unchanged in Q1 2023 (0.2%) with the Fancy Vivid category (0.6%) outperforming the Fancy (0.2%) and Fancy Intense (-0.4%) categories. Fancy Vivid 3 ct and Fancy 2 ct presented the highest climb, 1.9% and 1.7%, respectively. The weakest result was evident in Fancy 1 ct (-1.4%).

For a complete data analysis, please visit www.fcresearch.org

FCRF Board member Ephraim Zion:

“The price increases reflect the strong demand of yellow diamonds on the market as well as the strong competition in rough tenders. Despite some declines this quarter in White prices, Fancy diamonds are continuing to show stable demand.”

| Category | Q1/23 vs. Q4/22

T3 |

Q1/23 vs. Q1/22

TTM |

| All Fancy Color Diamonds | 1.3% | 4.1% |

| All Yellow Fancy Color Diamonds | 2.1% | 6.0% |

| All Pink Fancy Color Diamonds | 1.1% | 3.7% |

| All Blue Fancy Color Diamonds | 0.2% | 1.9% |

The Fancy Color Diamond Index is published by the non-profit Fancy Color Research Foundation (FCRF), tracking pricing data for Yellow, Pink, and Blue Fancy Color Diamonds in the major global trading centers – Hong Kong, New York, Geneva, and Tel Aviv.

About the FCRF

The Fancy Color Research Foundation (FCRF) provides fact-based support for Fancy Color Diamonds as an asset class and empowers sellers with the unparalleled proficiency that the field demands. A non-trading organization, the FCRF promotes transparency and fair trade through the Fancy Color Diamond Price Index, rarity data, auction analyses, commercial research and objective valuations. To learn more, go to https://www.fcresearch.org/